There Is an Inverse Relationship Between Bonds Quality Ratings

Question 2 There is an inverse relationship between bonds quality ratings and their required rates of return. There is an inverse relationship between bonds quality ratings and their required rates of return.

Amfie Academy Understanding Non Complex Bonds Amfie

Thus the required return is lowest for AAA-rated bonds and required returns increase as the ratings get lower.

. Thus the required return is lowest for AAA-rated bonds and required returns increase as the ratings get lower. There is an inverse relationship between bonds quality ratings and their required rates of return. Thus the required return is lowest for AAA-rated bonds and required returns increase as the ratings get lower TRUE the price sensitivity of a bond to a given change in interest rates is generally greater the longer the bonds remaining maturity.

There is an inverse relationship between bonds quality ratings and their required rates of return. The fitch sheet shows a variety of transaction details including the price volume time of. Thus the required return is lowest for AAA-rated bonds and required returns increase as the ratings get lower.

A data sheet containing historical listings of trades for a security. Thus the required return is highest for AAA-rated bonds and required returns increase as the bond ratings get higher. False BrainMass Inc.

There is an inverse relationship between bond ratings and the required return on a bond. Thus the required return is lowest for AAA-rated bonds and required returns decrease as the bond ratings get higherA. The required return is lowest for AAA rated bonds and required returns increase as the ratings get lower.

Thus the required return is lowest for AAA-rated bonds and required returns decrease as the bond ratings get higher. Is this statement true or false. A call provision gives bondholders the right to demand or call for repayment of a bond.

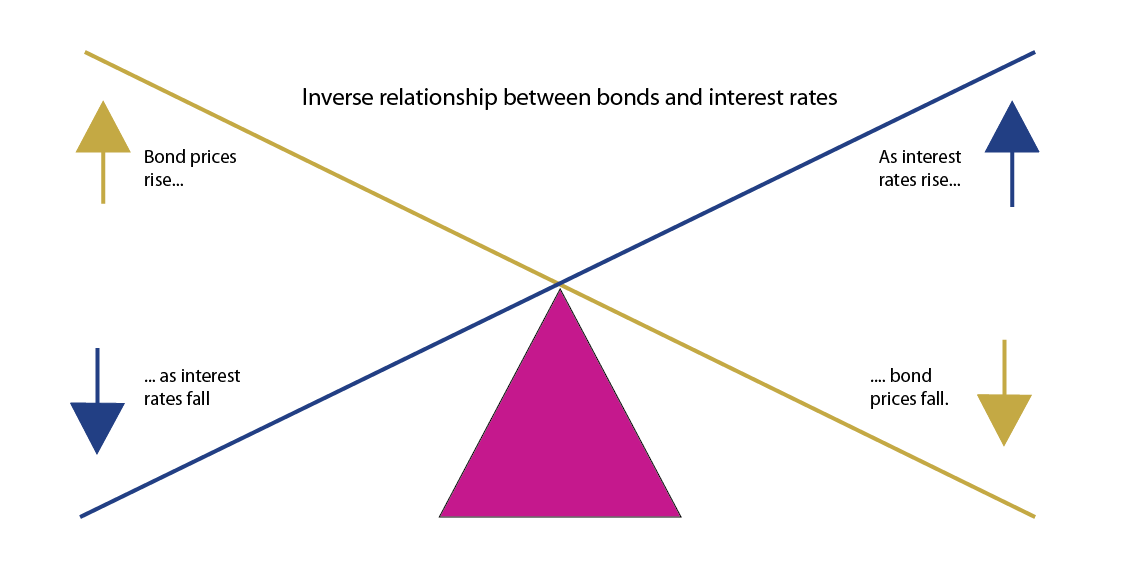

There is an inverse relationship between bonds quality ratings and their required rates of return. Thus the required return is lowest for AAA - rated bonds and required returns increase as the ratings get lower. When the cost of borrowing money rises when interest rates rise bond prices usually fall.

The primary question in bond rating analysis is whether the firm can service its debt. Question 1 There is an inverse relationship between bonds quality ratings and their required rates of return. There is an inverse relationship between yield to maturity and duration.

There is an inverse relationship between bonds quality ratings and their required rates of return. There is an inverse relationship between bonds quality ratings and their required rates of return. Thus the required return is lowest for AAA-rated bonds and required returns increase as the ratings get lower true or false Expert Answer 100 3 ratings.

True False The conversion feature of a bond is a feature that is included in almost all corporate bond issues that gives the issuer the opportunity to repurchase bonds at a stated price prior to maturity. There is an inverse relationship between bonds quality ratings and their required rates of return. 1 There is an inverse relationship between bonds quality ratings and their required rates of return.

As a result bond prices fall as interest rates rise since there is an inverse relationship between interest rates and bond prices. Bond prices and stocks are generally correlated to one another. To yield to maturity of a particular quality bond.

Thus the required return is lowest for AAA-rated bonds and required returns decrease as the bond ratings get higher. True False There is an inverse relationship between the quality or rating of a bond and the rate of return it must provide bondholders. Write a couple of sentences explaining your answer Answers Answer from.

Thus the coupon interest rate is lowest for AAA-rated bonds and the coupon interest rates increase as the bond ratings get lower. There is an inverse relationship between bonds quality ratings and their required rates of return. Accounting questions and answers.

True The price sensitivity of a bond to a given change in interest rates is generally greater the longer the bonds remaining maturity. Bond ratings and required returns There is an inverse relationship between bonds quality ratings and their required rates of return. Thus the required return is lowest for aaa-rated bonds and required returns increase as the ratings get lower.

There is an inverse relationship between bonds quality ratings and their required rates of return. Though the specific evaluation methodologies of each bond rating agency is proprietary there are general relationships between the ratings and factors like yield. There is an inverse relationship between bonds quality ratings and the coupon interest rates they offer.

Bonds have an inverse relationship to interest rates. Thus the required return is lowest for AAA-rated bonds and required returns increase as the ratings get lower. Thus the required return is lowest for AAA-rated bonds and required returns increase as the ratings get lower.

Lower rated bonds are a bit riskier but can hold higher returns. Factors Impacting Bond Ratings.

Solved Question 1 1 Point Saved There Is An Inverse Chegg Com

:max_bytes(150000):strip_icc()/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

No comments for "There Is an Inverse Relationship Between Bonds Quality Ratings"

Post a Comment